We are a securities firm specialising in Hong Kong and overseas listing, IPO sponsorship, underwriting, pre-IPO and post-IPO financing, mergers and acquisitions, Listing Rules and Hong Kong Codes on Takeovers and Mergers and Share Buy-backs related transactions and compliance adviser services. Our team consists of financial professionals with Hong Kong and China backgrounds, who have extensive experiences in the investment banking and corporate finance industry.

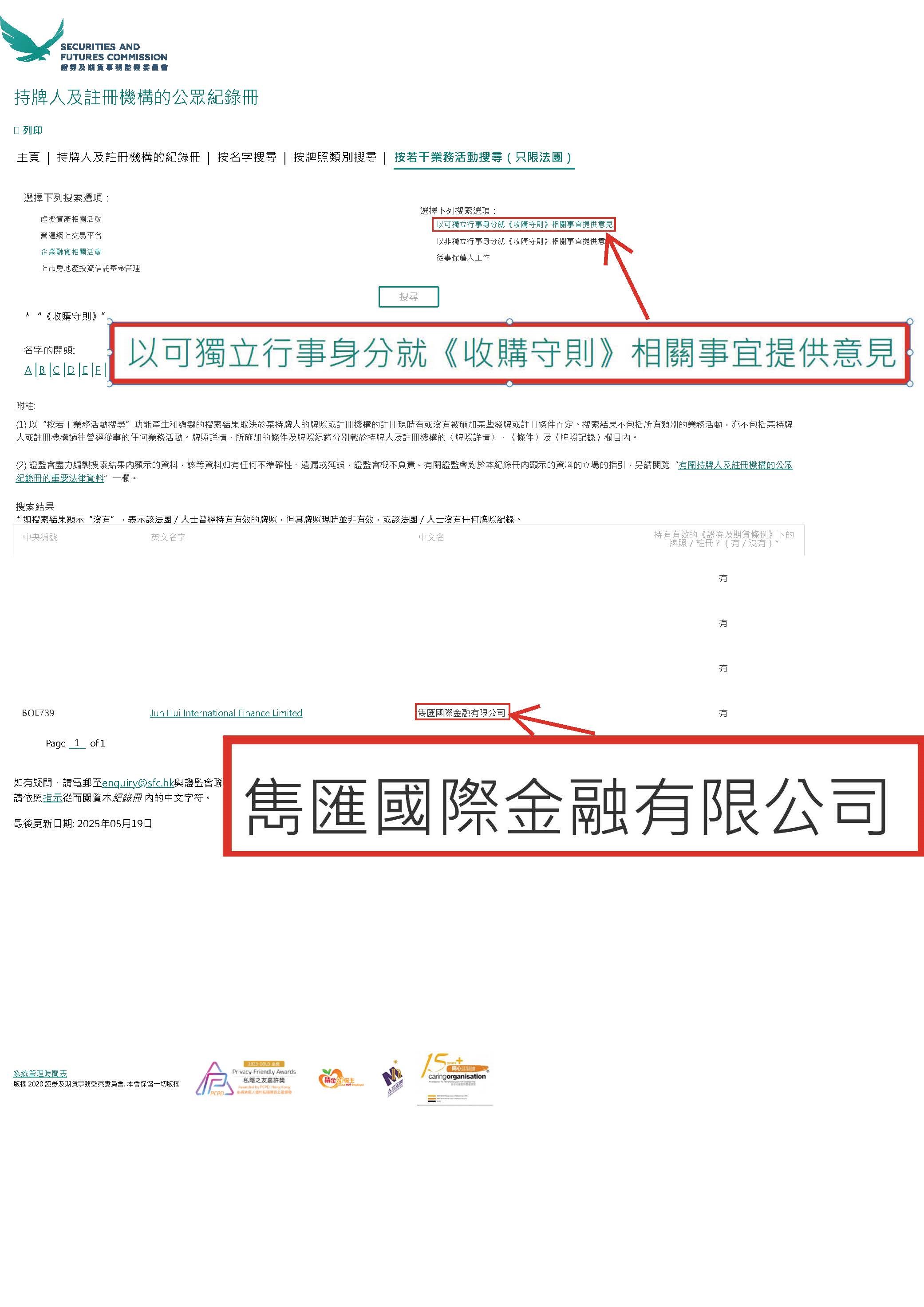

We, Jun Hui International Finance Limited (CE No.: BOE739), are a licensed corporation permitted to carry out Type 6 (advising on corporate finance) regulated activity under the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). We are eligible to act as a sponsor and a compliance adviser, and to undertake activities in connection with matters regulated by the Hong Kong Codes on Takeovers and Mergers and Share Buy-backs.

As a professional securities firm specialising in Hong Kong and overseas listings, IPO sponsorship, general offers, underwriting, pre-IPO and post-IPO financing, mergers and acquisitions and compliance advisory services. Our expertise extends to providing comprehensive corporate finance advisory services to both publicly listed companies in Hong Kong and private enterprises. Additionally, we assist businesses seeking global expansion by facilitating overseas listings in major capital markets, including the United States and Singapore.

Our competitive edge lies in our experienced management team, which has built a strong network to secure diverse sources of funding and deliver tailored solutions to our valued clients. With deep expertise in Hong Kong and China’s financial markets and regulations—as well as up-to-date industry insights—we provide comprehensive corporate finance advisory services across sectors such as property development, property management, technology, consumer goods, finance, new energy, manufacturing and media.

Our team of seasoned financial professionals brings extensive cross-border expertise in investment banking and corporate finance, specialising in Hong Kong and overseas IPOs, general offers, underwriting, M&A, restructuring and compliance advisory. We have successfully advised listed companies on complex transactions including general offers, notifiable/connected transactions, and reverse takeovers, while our China specialists have executed numerous H-share listings, corporate bonds, and red-chip IPOs for both state-owned and private enterprises, delivering tailored solutions for every client's needs.

Sponsor license

Takeovers Code license